By Jayme Amos. Get free updates of posts here

I’ve seen hundreds of commercial leases – and dentists all over the country are looking for the right answers. Unfortunately, not all dental real estate brokers can give you the same results.

Lucky for you, I’m not a dental real estate broker.

Even better, I’m not a dentist.

Better yet, I work with dentists and I get paid nothing if you sign a lease.

So, unlike dental real estate brokers, I’m 100% unbiased.

What you read below may turn some people off in the commercial real estate world but the tips will absolutely help dentists get the right lease.

Even If you Don’t Have

The Best Dental Real Estate Broker

The 6 Tips below could give you massive protection in your lease – even if the broker isn’t the best.

Dentists need an unbiased perspective and this is where you’ll find it.

Below, you’ll find 6 Tips that must be considered by you and your dental real estate broker. These are powerful, unbiased, unfiltered tips that reveal how you can get you started with a great lease.

Jump In: Learn 6 Tips

From My Real-Life Client Discussion

I recently had a conversation with a client who was right in the middle of negotiations for his Letter of Intent.

This entire article addresses the exact issues we discussed. Some of it is word-for-word.

He, like so many dentists, wasn’t sure his real estate broker was right for his dental practice and he asked me to help.

Below, you’ll be reading real excerpts from my conversation with him.

Take these tips and apply them to your next lease!

Bonus: Read to the end and get free access to the explosive article “5 Most Expensive Real Estate Fails – How Dentists Win” Get a free copy here

The 6 Topics:

- What is the LOI from your dental real estate broker?

- What Percentage of Production Should Rent Consume?

- What Name Should I Use on My Lease?

- What Rent Increases are fair?

- When do I get free construction money (do you want it)?

- Don’t all landlords use the same Lease Documents?

#1

What is the LOI

From Your Dental Real Estate Broker?

The LOI is the set of initials that stand for the Letter of Intent.

This is a document you’ll negotiate with the landlord before you sign (or even see) your lease.

“Dental real estate brokers may refer to this

as the LOI, the Letter of Intent”.

The LOI will typically be a 1-2 page document that acts like an abbreviated lease. This allows you to put some of your most important terms in writing, up front.

The LOI is normally non-binding which means you won’t be stuck if you sign it.

TIP: Be sure your dental real estate broker includes language in your LOI that says it’s a non-binding agreement.

How many details should be negotiated in the LOI?

The right dental real estate broker will delicately balance the key items needed in the LOI while leaving you room to negotiate the rest of the lease.

They’ll also know the specific ways to do this  for dental practices.

for dental practices.

There are some terms I suggest you include in the LOI, and some which are better left for later negotiations – you’ll see a few of them below.

It’s important you don’t include too many items in the LOI.

Key portions of the lease negotiation process should be saved for the stage when you have your full lease to review.

Next we’ll disclose the raw data about the price of your lease.Rent must be targeted as a percentage of total production for your practice to maintain balanced profitability.

Too few doctors are told that

the price of the lease should fall

within a specific percentage of production.

We’ll look at Rent as a Percentage of Production next.

All the following tips will set up important pieces of your LOI and get you ready for your official lease.

#2

What Percentage of Production

Should Rent Consume?

From my Client:

> This will be a follow up email from the

> previous email I have just sent today regarding similar issues. After

> talking to my lawyer, he brought up the problem with the rent where

> the rent should be maximum 8-9% of the revenue, and he believes my

> rent is too high. He also brought up many other points that I will

> just copy and paste here:

Yes, he’s right. Rent should be a maximum of 8-9% of production per year.

The ADA national average is actually closer to 6-7%.

That being said, let’s consider some scenarios:

SCENARIO 1

Your Practice Produces: $500,000

Your Rent Would be: $30,000-$35,000 (I forget your CAM fees)

In this scenario, your first-year rent is scheduled to be exactly 6-7%.

Or consider this common scenario for many first year start-up practices…

Or consider this common scenario for many first year start-up practices…

Many start-up practices will produce only $350,000-$400,000 in their first year. I normally like to see my start up clients produce $400,000-$500,000 as a result of a strong marketing budget…but let’s consider a lower possibility:

SCENARIO 2

Your Practice’s First-Year Revenue: $350,000

Your Rent Would be: $30,000-$35,000

In this scenario, your first year rent would consume 9-10% of production.

That’s too high…but it’s based on your first year production.

It is highly unlikely that you will produce that little or that you would produce that low of an amount after your first year.

In the event that you do, in fact, produce that little in your first year, you will need to use some of your working capital or cash reserves.

If you use $10,000 of your cash reserves in your first year, you will have used working capital properly AND simultaneously subsidized your rent to a level where your rent percentage of production is right back in line with appropriate percentages ($350,000 / $25,000 = 7.1%)

In this scenario, 7.1% is right back in line with the proper percentages…and this is acceptable for a first year practice.

I believe the caution of rent being too high is valid but only a concern if you produce well under $400,000 multiple years in a row.

While anything is possible, a worrisome scenario like producing less than $400,000 per year for a doctor in the right demographics with a strong marketing budget and a focused business mind is very unlikely.

[NOTE: Practices can grow with ease if they’re in the right town. Please read this article on demographics to choose a town that will be poised for strong growth. Find the Article HERE

Summary: I think your rent is at a good level. Lower is always better but I think your current rent rate and your current vision align well.

#3

What Name Should I Use On My Lease?

Most often, I advise clients to use their entity name on their lease.

Your “Entity” is your LLC, your P.C. or your Corporation name.

In other words, don’t use your personal name, use your entity name.

Why?

An attorney can give you the right advice on this topic but I’m confident they’ll tell you your risk levels (and perhaps legal exposure to liability) can be much lower when you use your entity name.

This is best agreed on in the LOI but is often left unresolved until the final lease is negotiated in cases where it is unintentionally left unresolved. In this case, I feel it would be good to modify the LOI.

TIP: Be sure your dental real estate broker knows to use your entity name in your LOI.

Most likely: your landlord will accept tenancy being written in your PC name and simultaneously require that you personal guarantee the lease.

Ideal for You: it would be ideal if you had no personal guarantee and tenancy in the name of the PC. Though it’s not likely for a landlord to agree to this, the benefit is worth pursuing.

#4

What Rent Increases Are Fair

For a Dental Real Estate Lease?

From my client’s dental real estate broker:

“7.5% increase in rent upon exercising of option almost ensures that you will have to move at some point. Rent should be adjusted according to CPI, not arbitrary increase.”

I don’t agree.

While I see the broker’s point, let’s examine the reality here.

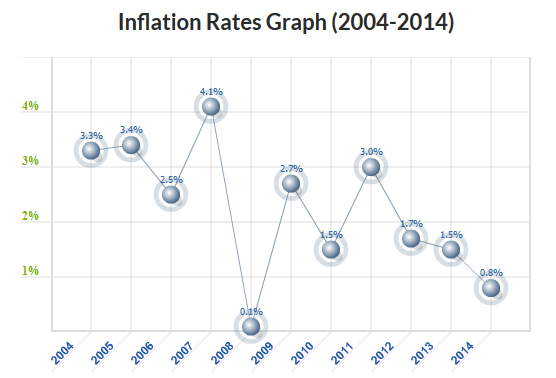

Often times, rent increases are tied to “CPI”

What’s CPI?

CPI is the acronym for Consumer Price Index

The doctor’s Letter of Intent currently states that rent increases “will increase 7.5% per lease term”.

The broker is suggesting the doctor must index the future rent increases to CPI.

Again, I disagree.

Is that good or bad?

I agree with the thoughts above in theory but I believe the rent increases of 7.5% are acceptable.

In this case, tying rent increases to CPI would be more expensive.to the doctor.

According to my client’s LOI, the rent increases are once every 5 years.

This equates to an increase of just 1.5% per year.

See the following chart to determine for yourself if 1.5% per year or CPI is best.

In all but 2 years of the last 10, a lease tied to CPI would have paid more.

http://www.usinflationcalculator.com/inflation/current-inflation-rates/

Summary on Rent Increases:

Planned rent increases are highly common.

Dental real estate leases have precise needs, especially with respect to rent increases. Sometimes tying a rent increase to CPI is good, but in this case, the doctor should accept the 7.5% increase over 5 years because it will most likely cost less than a CPI increase.

#5

Free Construction Money

(also known as “T.I.”)

From my client’s broker:

“I’ve seen other leases where the landlord agrees to do a certain amount of work to at a certain budget to get the office set up for the doctor. In this case, you’ll be paying for everything yourself. All they have to do is give you ‘heated room’. You should push to have plumbing or electrical installed. I’ve also seen landlords include putting in carpeting or painting the premises as part of the deal. In any event the exact scope of the landlords work should be detailed if they mean to offer more than just a heated room, and ideally they will provide more than just a heated room.”

This is normally called “T.I.” Allowance or “Tenant Improvement” Allowance.

The broker is suggesting that the doctor ask the landlord to pay for a certain amount of construction costs.

My answer: yes, it is very common to have landlords assist in buildout costs.

However, there are some serious considerations to make before you ask for T.I.

(want to see the most impactful costs? Read this article on Dental Construction Costs

Commonly, a tenant will negotiate a lease that will include a few dollars per square foot in “free construction”.

In these situations, the landlord pays for and sometimes hires to perform the services at his expense.

TIP: If your lease includes T.I., make sure the allowance is paid to your contractor. There are specific criteria for hiring a dental construction firm and we don’t want your landlord choosing someone unqualified.

specific criteria for hiring a dental construction firm and we don’t want your landlord choosing someone unqualified.

How does a landlord afford to do pay a T.I. Allowance?

Remember, the landlord is a business.

If his “landlord business” gives you something for “free”, you will ultimately pay for that service in higher rent.

Commercial landlords are very good with calculators and they make it their business not to lose money to tenants.

Particularly with commercial real estate,

if a landlord pays for T.I., you will likely pay a higher rent.

Example: if you ask for TI Allowance of $30,000, it’s likely that your rent will be higher over the course of the lease.

If rent is higher by $1 per square foot, the cost of that $1 over 10 years is $30,000.

In other words, nothing is free – even TI.

My specific thoughts: I believe this doctor has a negotiated rent rate that is below-market rate.

If T.I. can be obtained without raising rent, then a T.I. Allowance would be great news.

But if rent increases even $1 per square foot as a result of the T.I. allowance, the doctor will likely lose money.

This is one of those cases my dad told me about: there’s no such thing as a free lunch.

More Important Than T.I. Allowance

More important than the price of the rent, is that fact that the space and the demographics fit the doctor’s long term vision.

The location itself must fit you and your vision.

With low rent for this doctor’s region and a right-fit for his vision, I would not recommend fighting hard for TI.

TIP: The demographics and future potential unique to your practice goals must be in line with your space.

Suggestion: propose in the agreement a $3 psf TI Allowance on “The advice of your advisors”. This would equal $3 x 2944, or $8834. If you “get it”, good. If you don’t, it’s ok.

Suggestion: propose in the agreement a $3 psf TI Allowance on “The advice of your advisors”. This would equal $3 x 2944, or $8834. If you “get it”, good. If you don’t, it’s ok.

The $8834 will not impact your bigger vision.

What will impact your bigger vision?

Your lease. And, as you’ll see in Section #6, below, there are a few things you need to know about landlords and how they make customized leases.

Final Word on “Free Construction”: In this case, this is a small issue and you shouldn’t feel like you’re “missing out” on “free” construction.

#6

Aren’t all Leases the Same?

No way.

The realities of a commercial dental real estate lease will shock you.

Commercial real estate is a dangerous world, particularly for dentists.

One of the main reasons the commercial real estate world is so complicated is because nearly every landlord has their own, customized lease.

They spend tens of thousands of dollars getting the lease the way they want;

a way that benefits them, not you.

Your landlord makes is his job to win with subtle lease negotiations to protect his investment, not yours.

For these reasons, you must have the right dental real estate broker guide you through this. The risks and costs are just too high.

If your broker needs guidance, let us know.

You’ll have hundreds of thousands of dollars at risk (you can calculate them here:)

It’s imperative that you remember that commercial leases afford you none of the same protections that your old residential lease from college got you.

“Your college lease protected you.

Your dental lease protects your landlord.”

Don’t be fooled – get the right information and you’ll protect your future and create a much more profitable future.

Bonus: Read to the end and get free access to the explosive article “5 Most Expensive Real Estate Fails – How Dentists Win” Get a free copy here

Summary

Your lease can make you or break you.

And it all starts with the right LOI and the right team.

A great dental real estate broker will know dentistry at a deep level.

They’ll be capable of planning and strategizing with you in each of the 6 topics we’ve discussed.

The way you handle these 6 topics in your lease will have a big effect on your future.

Will your lease have a positive or a negative effect on your future?

You can do this and you can succeed.

Get the right team on your side and you’ll create a path for your future that will protect you and help you create a wonderful, profitable practice.

Best,

Jayme

PS: Click the SHARE button below…your colleagues need this information too!

PPS: Get your free article now: The 5 Most Expensive Real Estate Fails

IMPORTANT NOTE: Please note that, as a non-attorney, anything in this article is solely my personal opinion, not legal advice. As such, please make your final opinion with the help of an attorney.